Art investment has grown from a niche hobby for the wealthy into a mainstream option for diversifying investment portfolios. With the global economy often facing fluctuations, many investors are turning to the art market as a reliable asset class that offers a hedge against volatility. Over the past few decades, the art market has seen impressive growth, with the value of contemporary art rising steadily and consistently. According to the Artprice 100 Index, the global art market has surged by nearly 400% in the last 20 years, proving the potential for art as an alternative investment.

The Art Market’s Impressive Growth

At the end of World War II, there were only around 500,000 art collectors worldwide. Today, more than 70 million people invest in art, a clear indicator of the growing appeal of this asset class. In just 20 years, art sales revenue has grown from $3.2 billion in 2000 to a staggering $13.3 billion by 2019. Contemporary art alone now accounts for about 40% of the global art market.

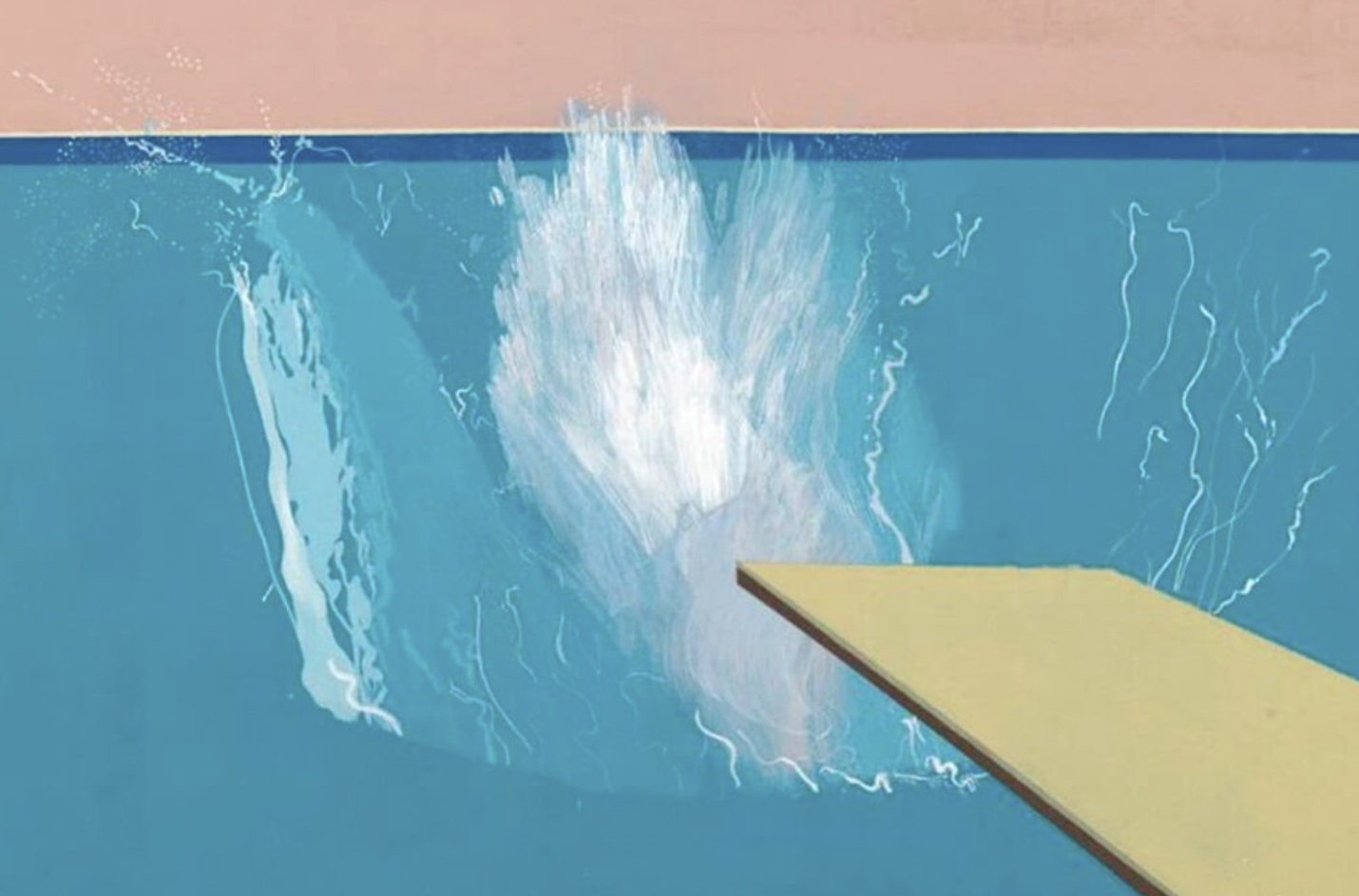

Noteworthy sales have contributed to the growth of the sector, such as Leonardo da Vinci’s Salvator Mundi, which sold for $450 million in 2017. Works by renowned contemporary artists, including Jackson Pollock, David Hockney, Mark Rothko, and Edward Hopper, have also fetched record-breaking prices. While the art market is often associated with famous pieces, buying works from emerging artists can also prove to be a wise investment, with some artworks appreciating substantially over time.

Fine Art as a Viable Investment Option

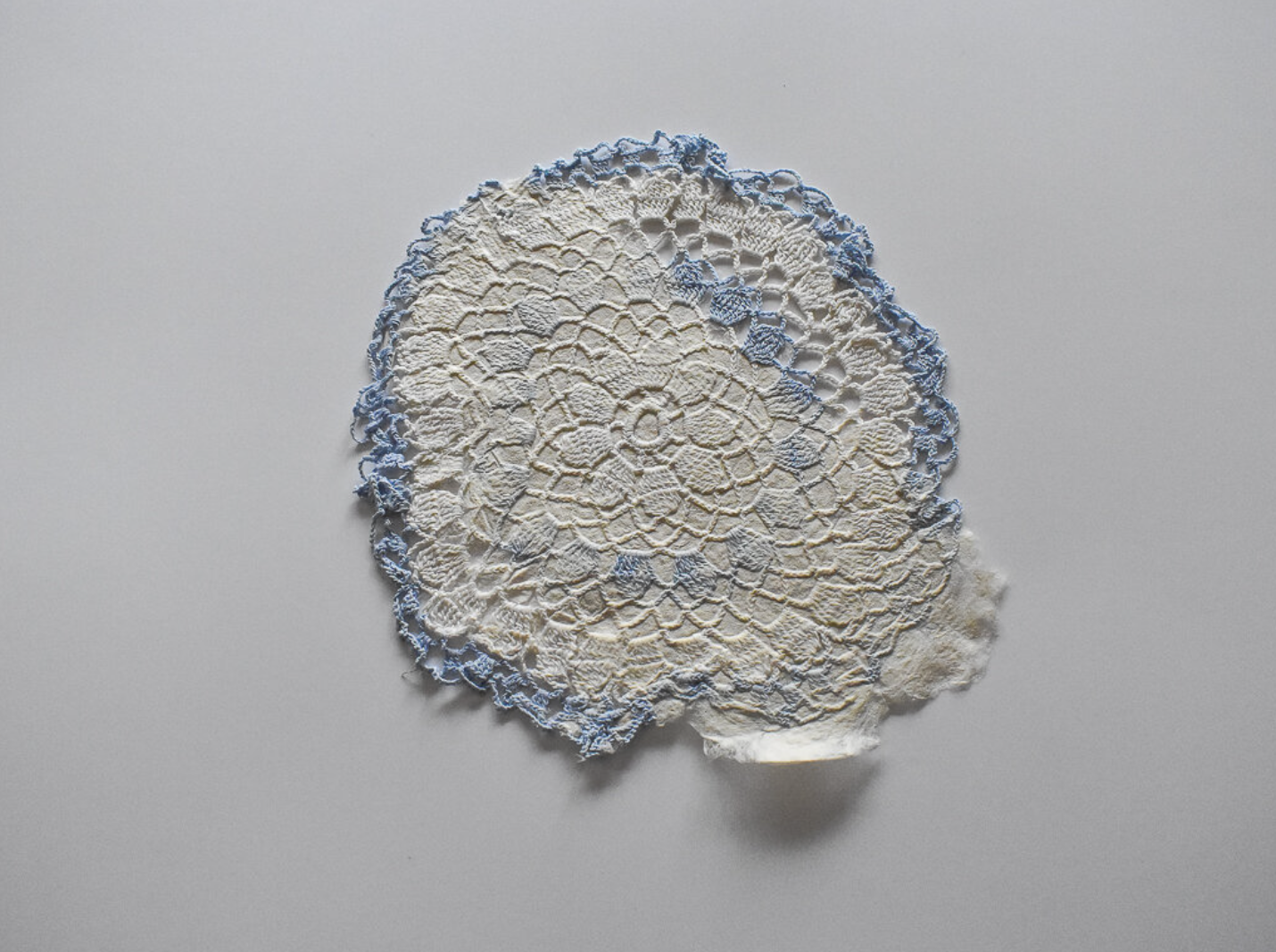

Art investment is no longer just for high-end collectors and art aficionados. It has become an important strategy for diversifying financial portfolios, with many investors exploring its potential for both personal enjoyment and financial gain. According to Artprice’s 2018 report, around 80% of art sales were for pieces priced under $5,000, making it accessible for those just starting their investment journey. By choosing emerging artists and making informed purchases, it’s possible to invest in art that will increase in value over time.

The Rise of the Online Art Market

The contemporary art market is undergoing a digital transformation, with online art sales experiencing rapid growth. Numerous virtual galleries have emerged, offering easier access to art for investors and collectors around the world. However, it’s crucial to ensure that the platforms you use are trustworthy and reliable. While some online art marketplaces are well-established and offer robust customer support, others may not be as reputable.

One platform that has gained attention in the art world is Artalistic, a leading online art gallery. Known for its credibility and strong customer service, Artalistic has earned recognition from industry experts and media outlets, including a feature in Forbes, where founder Cynthia Soddu shared insights into the platform’s success.

The Financial Advantages of Art Investment

Investing in fine art provides several financial benefits. It’s a stable asset class, particularly when incorporated into a well-planned investment strategy. Additionally, art investment offers attractive tax benefits in many countries, as art is not subject to annual taxes. In most cases, art is only taxed at the time of purchase, making it an appealing option for those seeking to preserve wealth over the long term.

How Artalistic Can Help You Get Started

If you’re considering entering the world of art investment, platforms like Artalistic make it easy to begin your journey. With thousands of paintings, sculptures, photographs, and other artworks available, Artalistic offers a broad selection of pieces to suit any investor’s preferences. The platform is managed by a team of experienced professionals who ensure that all artwork listed is authentic and verified. Their goal is to provide a seamless experience from purchase to resale, helping you make informed investment choices while also enhancing your collection.

Tailored Support for Art Investors

Navigating the complexities of the art market can be challenging, but with the right guidance, it’s possible to achieve optimal portfolio diversification. Artalistic’s team of specialists brings years of expertise to the table, offering valuable insights into current market trends and helping you select the right pieces for your investment goals.

Whether you’re new to art investment or a seasoned collector, Artalistic’s customer support is available to guide you through every step of the process. If you have questions or need assistance, their team is ready to provide personalized advice to ensure your investment strategy aligns with your financial objectives.

Conclusion

Art investment is no longer a luxury reserved for the elite—today, it’s a mainstream option for diversifying portfolios and generating long-term wealth. With a growing market, accessible pricing, and the rise of online platforms, it has never been easier to get involved. By making informed decisions and seeking guidance from experts, you can start building an art collection that not only brings aesthetic pleasure but also serves as a solid financial investment.