Buying art can be an enjoyable and rewarding experience, whether you’re an individual looking to invest or a company seeking to enhance your workspace. Beyond the visual appeal, purchasing artwork can also offer valuable tax benefits, especially in France. Here’s a breakdown of how you can take advantage of tax write-offs when buying fine art.

Tax Deductions on Art for Individuals

In France, art purchases can offer substantial tax benefits. Like other forms of investment, fine art can be a profitable asset, and certain rules allow individuals to benefit from tax exemptions. The good news is that fine art is not subject to the Impôt sur la Fortune Immobilière (IFI), or the Real Estate Wealth Tax, which means that art investments are exempt from this tax.

For individuals, the key takeaway is that purchasing fine art could significantly reduce your taxable income. Additionally, artworks can be used to settle inheritance taxes in France through a process called datation de paiement, which can be quite helpful during times when unexpected tax obligations arise.

What Types of Art Qualify for Tax Exemption?

French tax law has specific guidelines regarding what constitutes eligible artwork for tax exemption. These works of art include:

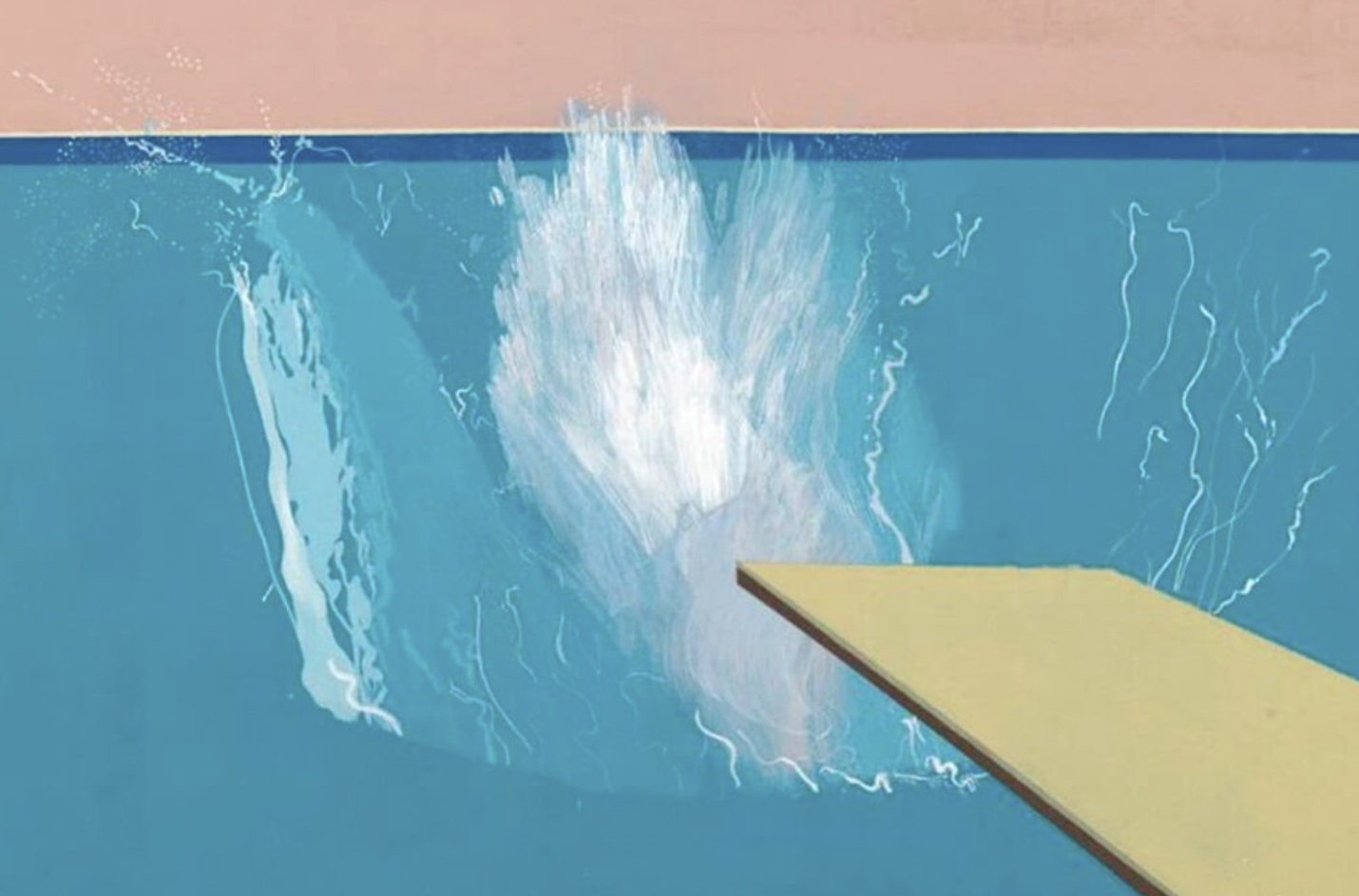

- Paintings, drawings, watercolors, gouaches, pastels, and monotypes.

- Engravings, such as woodcuts, linoleum, intaglio, and limited-edition lithographs.

- Signed and numbered photographs taken by the artist, with a limited series of fewer than 30 prints.

- Sculptures with a limited edition of 8 copies, either by the artist or their beneficiaries.

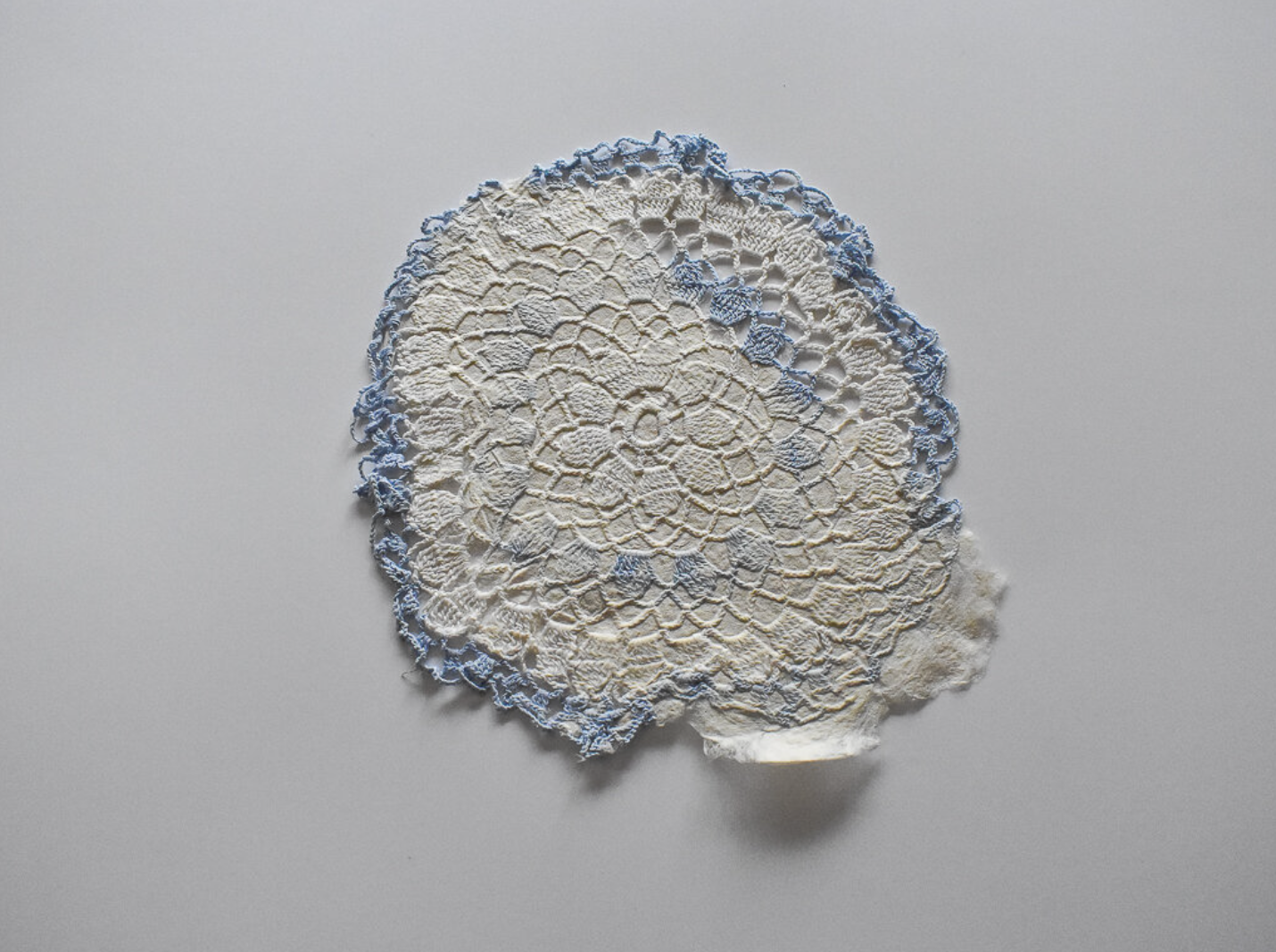

- Handmade tapestries.

Essentially, any collectible art piece can be considered for tax exemption, allowing individuals to use their art purchases to reduce their taxable income.

Selling Art and Capital Gains Tax

When you decide to sell artwork that you’ve previously purchased, it’s important to understand how capital gains tax applies. If you sell a piece for more than €5,000, the sale will be subject to taxation. There are two options for how this tax can be calculated:

- Flat-rate tax: This is a straightforward tax applied to the sale price, set at 6.5%. However, if the artwork contains precious metals, the tax rate increases to 11.5%.

- Capital gains tax: This tax is based on the difference between the purchase price and the sale price of the artwork. The rate for capital gains is 36.2%, but a 5% tax deduction applies for each year the piece has been owned, starting after two years of ownership. After 20 years, the capital gains tax can be fully exempted.

Art Purchases for Companies: Tax Write-Offs

For companies and freelancers in France, buying art can be a smart way to enhance your workplace while taking advantage of tax write-offs. According to French law, businesses can claim deductions for purchasing original works of art by living artists. This tax exemption is available as long as the artwork is used within the company’s premises.

The purchase cost can be deducted from the company’s industrial and commercial profits (Bénéfices industriels et commerciaux – BIC), but only for companies subject to these types of taxes. Companies paying non-commercial profits (Bénéfices non commerciaux – BNC) do not qualify for this exemption.

Why Art Purchases are Beneficial for Companies

For businesses, investing in fine art offers a dual benefit: aesthetic enhancement and tax savings. There are several options for how art purchases can be deducted:

- A deduction of up to 0.50% of the company’s turnover (excluding taxes).

- A flat deduction of €20,000.

This means that the cost of an artwork can be deducted over five years, with one-fifth of the purchase price deducted each year. However, the total deduction cannot exceed 5% of the company’s annual turnover.

Accounting and Contractual Requirements for Companies

When companies purchase art for tax purposes, there are some essential accounting responsibilities:

- The artwork must be recorded as a fixed asset in the company’s accounting records.

- The tax deductions must be allocated to a special account, which is then reflected in the company’s balance sheet. This must be reported to the tax authorities annually.

Additionally, the law requires that purchased art must be displayed in public areas within the company for at least five years from the date of purchase. The artwork cannot be kept in private offices or areas not accessible to visitors or employees. The goal is to ensure that the artwork is available for public viewing.

By understanding these rules and taking the necessary steps, both individuals and businesses can benefit from significant tax deductions when buying art in France. Whether for personal investment or as part of a company’s strategy, purchasing art offers more than just visual appeal – it can also provide financial rewards.