Non-fungible tokens (NFTs) have been generating considerable buzz in the art world, raising the question of whether digital art in the form of NFTs could revolutionize the traditional art market. With iconic digital works like Beeple’s NFTs selling for millions, the investment potential seems undeniable. But while some investors view NFT art as a goldmine, others caution that it could be a speculative bubble. As the NFT market continues to grow rapidly, it’s essential to evaluate the pros and cons before jumping in.

What Are NFTs and Crypto Art?

NFTs are digital tokens that represent ownership of unique items, like art, music, or videos. Unlike traditional cryptocurrencies such as Bitcoin, which are interchangeable (or fungible), NFTs are one-of-a-kind and cannot be swapped for something identical. This uniqueness creates rarity and scarcity, attributes that often add value to NFTs. Since digital art can usually be duplicated endlessly, NFTs serve as a solution to this issue by providing a verified, irreplaceable form of ownership.

Since their inception in 2014, NFTs have become an increasingly popular way to buy, sell, and trade digital art. The technology is still relatively new, but its influence on the art world is growing, as artists and investors alike explore the potential of this digital marketplace.

Is NFT Art the New Normal?

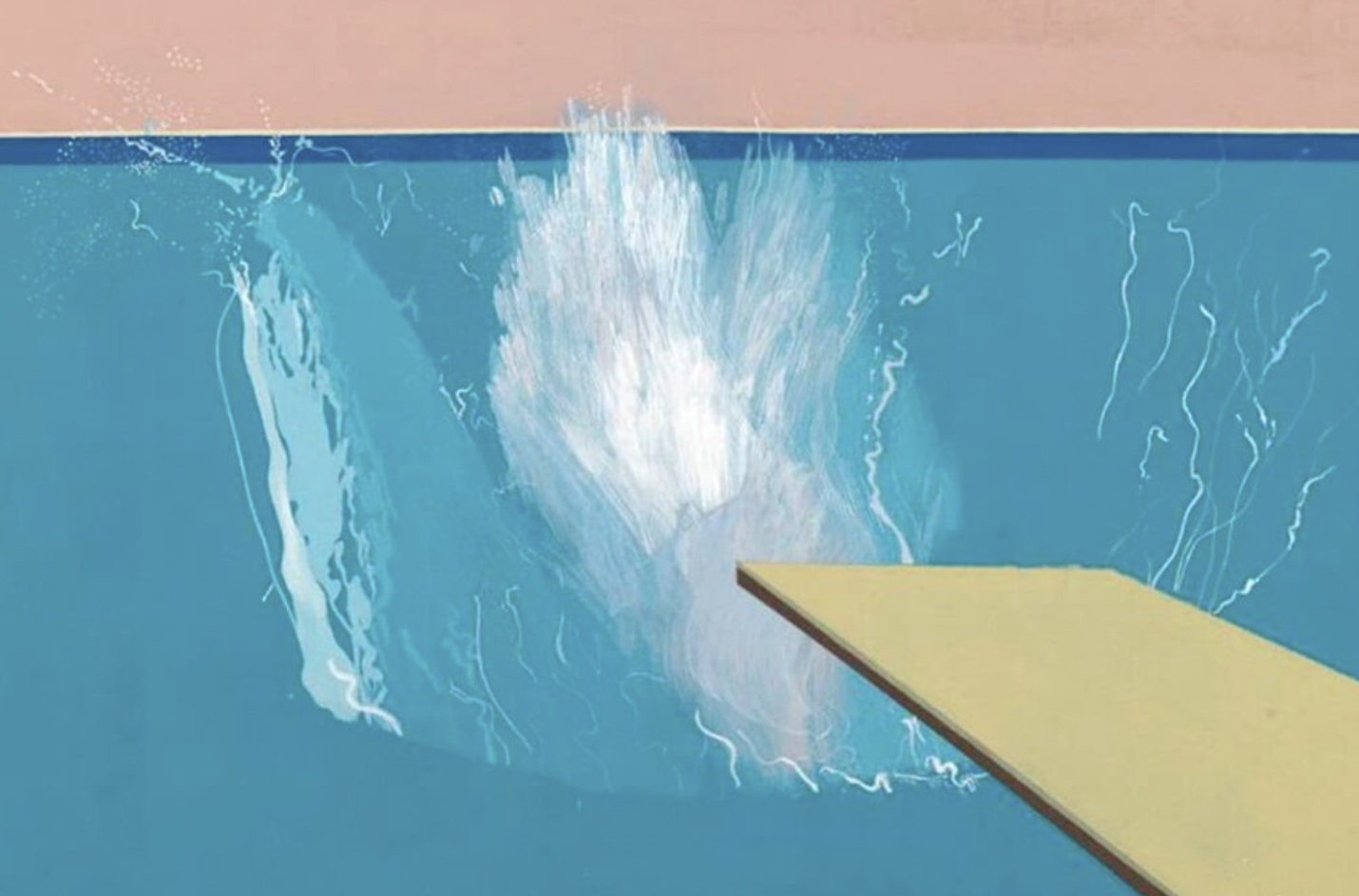

The value of NFTs is often compared to that of traditional art, such as classic paintings. Both forms are considered valuable due to their rarity and uniqueness, but NFTs are different in that they exist purely in the digital realm. This raises an interesting question: Could NFT art one day be just as valuable, or even more valuable, than physical art?

Many proponents of NFTs argue that these digital works are poised to become a significant part of the art world. Digital artists can now showcase their work to a global audience and receive fair compensation for their creations through blockchain-based transactions. This shift is seen by some as the next evolution in the democratization of art, as it eliminates the barriers to entry that have traditionally existed in the physical art world.

The Benefits of Investing in NFT Art

NFTs come with several advantages, particularly for digital artists and investors:

- New Market Opportunities for Digital Artists: Artists can monetize their work in ways that were previously impossible, allowing them to directly connect with buyers.

- Democratization of Art: Digital art makes it easier for artists worldwide to gain exposure and recognition, bypassing traditional galleries and auction houses.

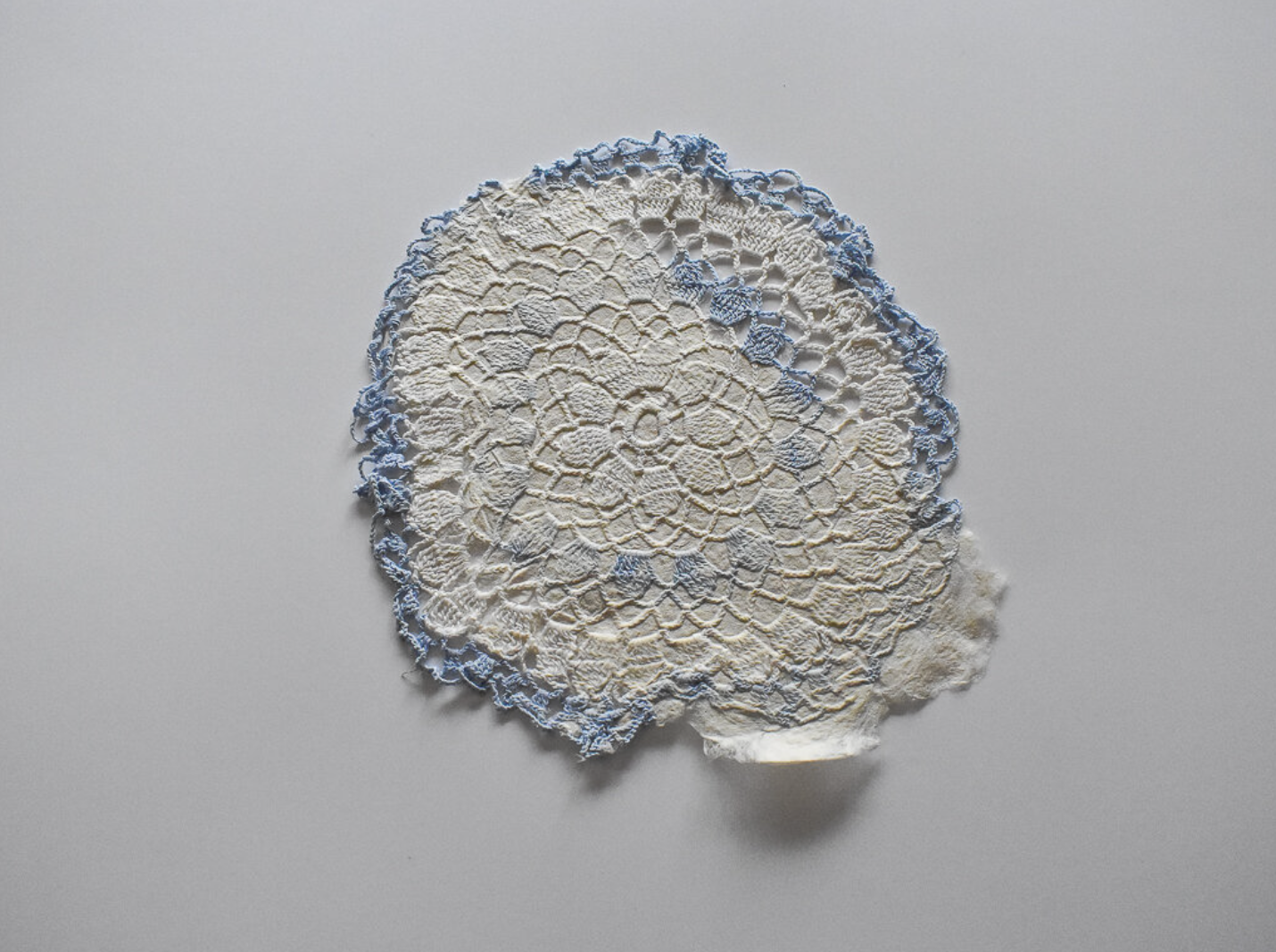

- Rarity and Authenticity: NFTs are verified on the blockchain, ensuring their rarity and authenticity, similar to a certificate of authenticity for a physical artwork.

In theory, these factors make NFTs an appealing investment. The blockchain infrastructure ensures transparency, and the use of unique digital signatures guarantees that each piece is one-of-a-kind.

The Drawbacks of NFT Art

While NFTs offer some exciting possibilities, there are several factors that investors should consider before diving into the market.

- Limited Physical Presence: Unlike traditional paintings, which can be displayed in galleries or homes for public enjoyment, NFTs lack a physical form. They exist as digital files, which makes them harder to display or interact with in the same way as physical artworks.

- Potential for Fragmentation: While an NFT may be unique, it can be divided into smaller parts and sold to multiple buyers. For instance, the NFT art piece The Merge was divided into over 266,000 digital units, which were sold to nearly 29,000 buyers. This undermines the concept of complete ownership, as multiple individuals can own a fraction of the artwork.

- Market Volatility: The NFT market is notoriously volatile. While certain works have appreciated in value, the market can also experience rapid fluctuations, as seen with the recent decline in cryptocurrency values. This makes investing in NFTs a high-risk endeavor, especially when compared to the more stable traditional art market.

- Environmental Concerns: NFTs and cryptocurrencies rely on blockchain technology, which is known for its significant environmental impact. The energy required to mint NFTs and process transactions on platforms like Ethereum can be enormous. However, Ethereum’s recent updates aim to reduce energy consumption, which could help mitigate some of the environmental concerns associated with NFTs.

Conclusion

NFTs have undeniably changed the way we view and interact with digital art. For some, they represent a cutting-edge opportunity to invest in a new and exciting market. For others, the risks—such as market instability and environmental impact—are too great. As with any emerging investment, it’s essential to do thorough research and approach the NFT market with caution.

Whether or not NFTs will replace traditional art in the future remains uncertain. What is clear is that digital art has a significant place in the modern world, and the rise of NFTs may have just begun.